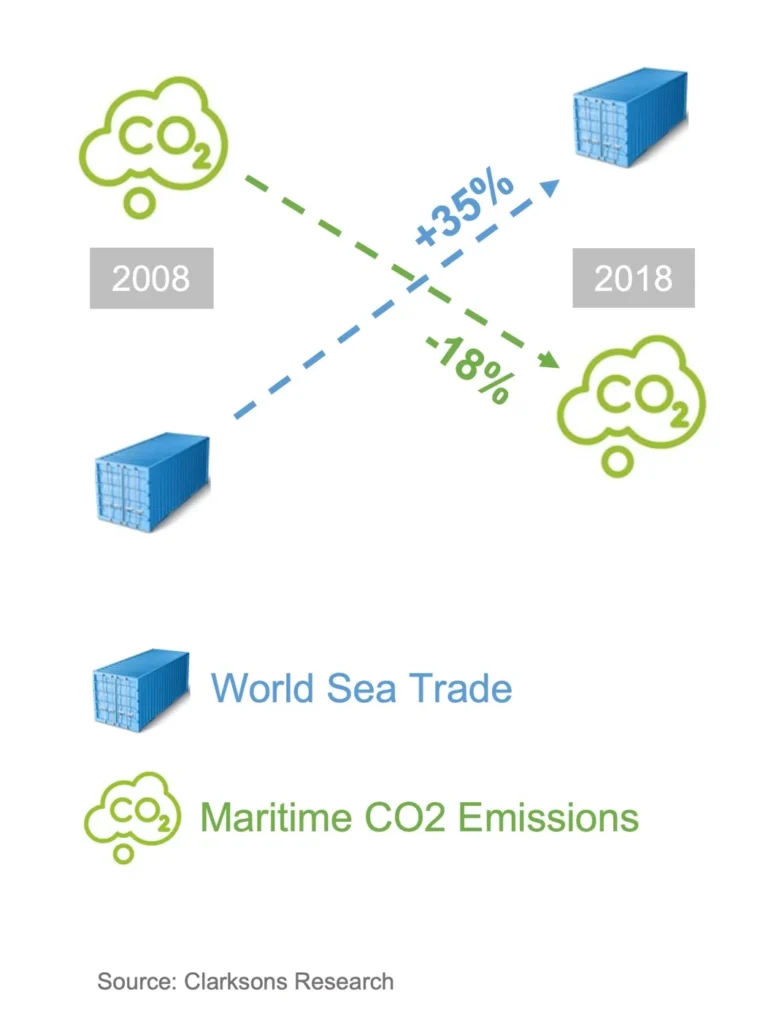

90% of the goods traded worldwide (and 40% within Europe) are transported by sea. Yet only about 3 % of all global CO2-Emissions come from shipping. Since 2008 goods transported by sea increased over 35 % while CO2-Emissions could get reduced by 18 % – a development that is foreseen for the years to come.

Briese Schiffahrt, together with its investors, owns the world’s largest multipurpose vessel fleet, totaling over 130 vessels. As the industry leader, Briese Schiffahrt not only operates young, modern multipurpose vessels, but also leads innovation in new shipbuilding. Briese Schiffahrt has ignited the “shipbuilding” cycle by ordering 15 vessels of the eco-efficient and load-maximized “LakerMax” series with schematics designed by Briese Schiffahrt.

Growing expansion in the energy sector will remain the driving force behind the demand for multipurpose vessels. It will keep the fleet busy for the years to come. Join our exciting journey and become an investor – we welcome you aboard!

Multipurpose (MPP) ships are by their design capable of carrying various cargoes. Compared to container ships and bulk carriers, multipurpose vessels are not built for specific cargo and are smaller. MPPs offer a high versatility and flexibility to load heavy and large project cargoes, unitised cargoes, containers and break bulk. Given the wide cargo range, vessels are required with large holds and cranes that often are combinable. The typical design of MPPs offers wide deck areas, moveable bulkheads that can also function as tween decks, crane capacity and container suitability. Tanktop strength, hatch cover supports, crane pedestals and ice strengthening are also important design elements.

Ultimately, MPP vessel owners benefit from a highly efficient and effective maritime infrastructure asset. In combination with Briese Schiffahrt’s dominance in the multipurpose/ project & heavy-lift industry attractive returns can get generated.

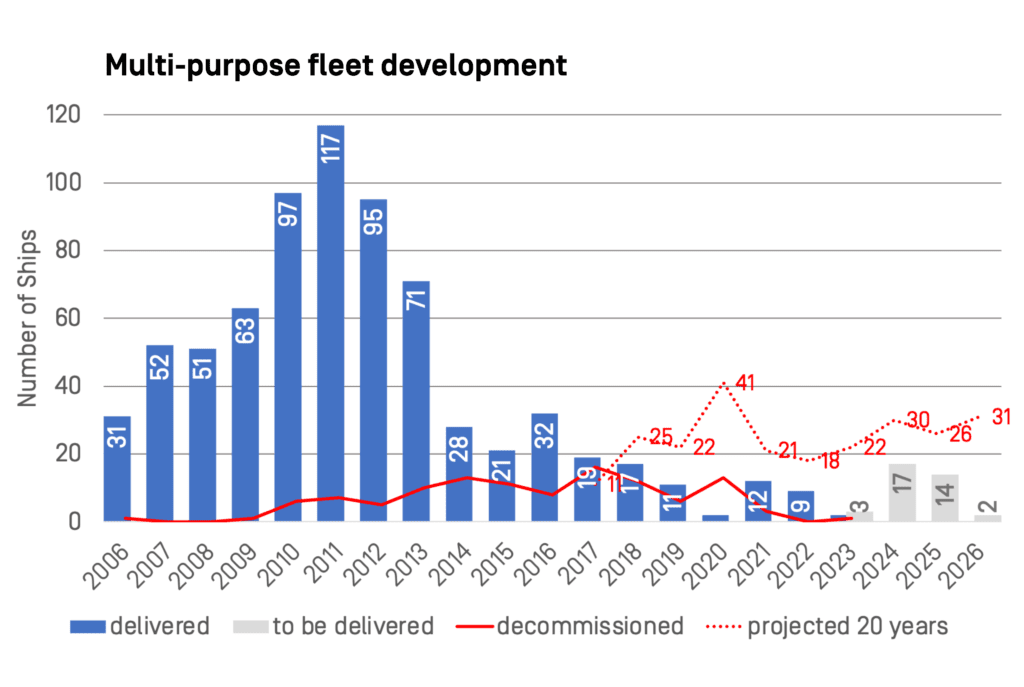

In the early 2000s the production cycle of new multipurpose vessels started with finding its peak in 2011. The overcapacity of vessels led to plummeting charter rates and almost a halt of newbuilding activity over the past decade. The result is an overaged multipurpose fleet with an average age of 21 years.

Knowing that the typical life span of a vessel is 25 years many vessels, and as a consequence loading capacity, will exit the global fleet over the coming years. Therefore, a new production cycle of new eco-efficient and load-maximized multipurpose vessels is imminent with Briese Schiffahrt igniting the trend.

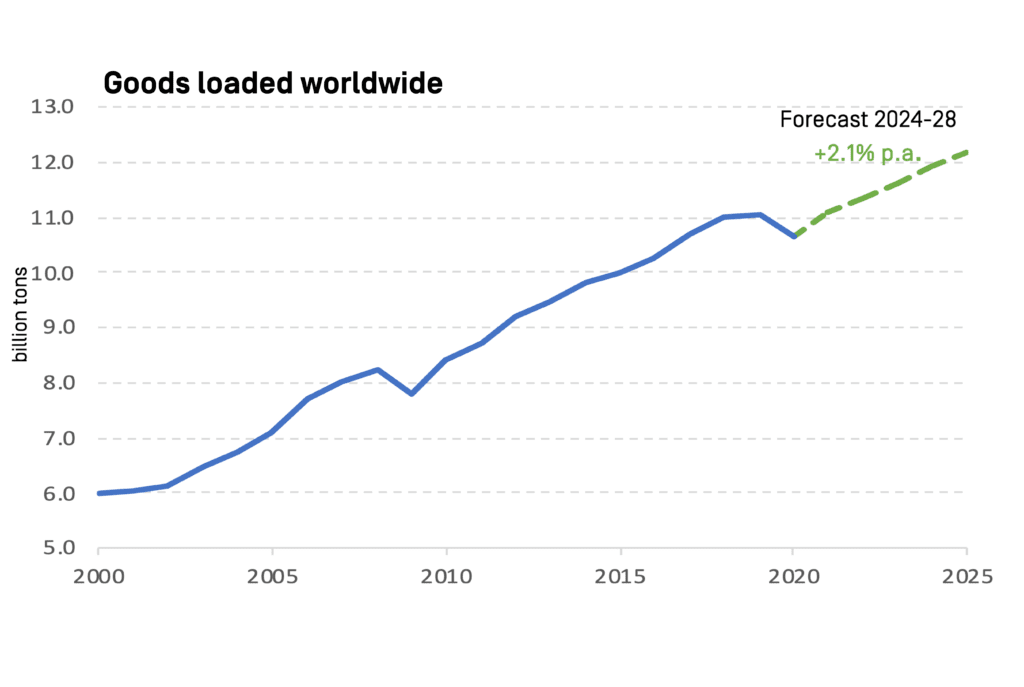

Maritime transportation is by far the most efficient also in regards of eco-efficiency. The goods loaded worldwide are on a steady growth path and, according to Clarksons Research, increased by over 35 % since 2008. UNCTAD forecasts an increase of +4,1% in 2021 and further growth for the years to come.

The multipurpose vessel newbuilding of the new Briese “LakerMax” series, with schematics designed by Briese Schiffahrt, will facilitate the world’s transportation needs, by offering over 40% more loading capacity while being up to 40% more eco-efficient vs. the vessels built in 2000s. As a consequence, the “LakerMax” series generates higher charter rates vs. its predecessor.

UN’s ‘Race To Zero’ is a global campaign to rally leadership and support from businesses, cities, regions, investors for a healthy, resilient, zero carbon recovery that prevents future threats, creates decent jobs, and unlocks inclusive, sustainable growth.

Wind is providing the largest contribution to renewable energy growth. According to the Global Wind Energy Council (GWEC): “2020 was the best year in history for the global wind industry but this growth is not sufficient to ensure the world achieves net zero by 2050. The world needs to be installing wind power three times faster over the next decade in order to stay on a net zero pathway and avoid the worst impacts of climate change.”.

Briese Schiffahrt is transporting a significant stake of the world’s overall renewable energy production, e.g. the majority of all wind turbines produced globally. Demand of energy infrastructure will further increase making transportation capacity of multipurpose/ project & heavy-lift carriers a scarce commodity.

During its 30+ years of existence, the family owned Briese Group has built, bought, operated and sold almost 200 vessels. The certified multi-decade track record shows an annual double-digit average return.

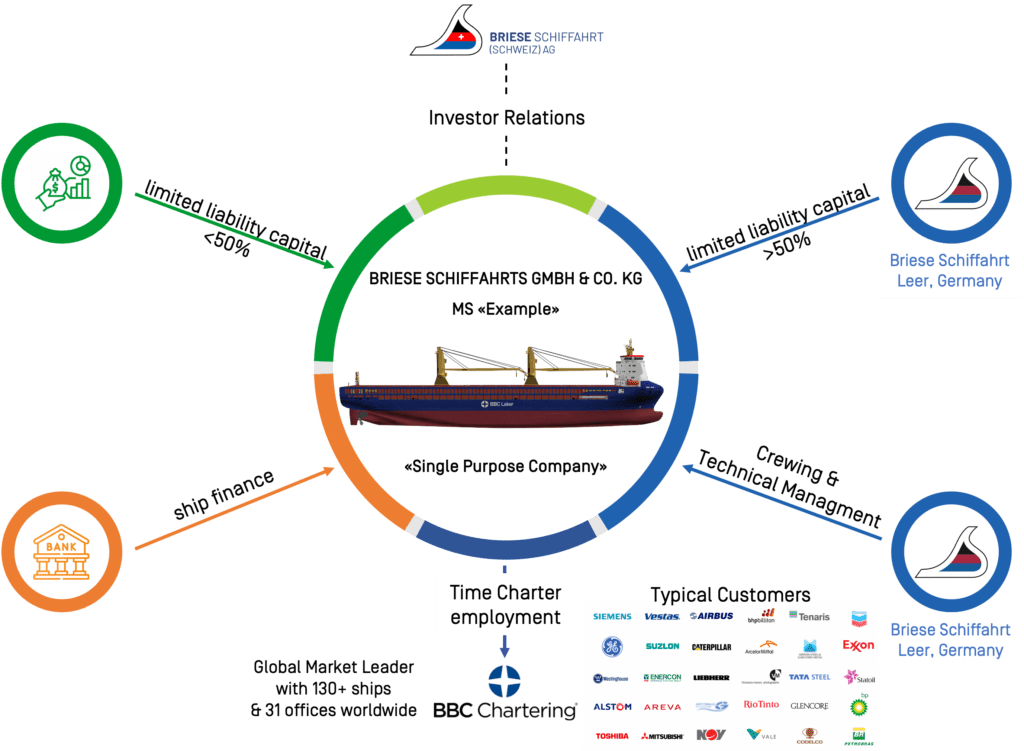

Each of Briese Schiffahrt’s multipurpose vessels are setup and operated in a dedicated entity (GmbH & Co. KG) domiciled in Germany. All vessels are registered in the German shipping register.

The equity capital is sourced by institutional and professional investors while Briese Schiffahrt itself contributes up to 50 % of equity.

In order to support Germany as a shipping location, the ‘tonnage tax’ or tonnage profit calculation was introduced in 1999. This is not a separate type of tax, but a special method of determining profits from the operation of merchant ships in international traffic by means of a lump-sum determination of profits. The legal basis for this ‘determination of profits from merchant ships in international traffic’ is Section 5a of the German Income Tax Act, whereby the prerequisites for its application are a commercial enterprise with its management in Germany, the operation of merchant ships in international traffic and the management in Germany. Accordingly, a lump-sum determination of profits results – irrespective of the commercial balance sheet or a possible tax balance sheet based on the ‘conventional’ determination of profits.

The tax consideration of this determined ‘tonnage profit’ for foreign investors in their tax assessment has to be examined separately; in particular against the background of a possible double taxation agreement and the applicable method (exemption or credit). Briese Schiffahrt (Schweiz) AG is supporting its Swiss investors to benefit from the German ‘tonnage tax’.

The advisory company – Briese Schiffahrt (Schweiz) AG – is under Swiss management which holds the controlling stake. While partnering up with Briese Schiffahrt in Germany, the Swiss management is acting independently and is dedicated to its investors. Investors are accompanied during the complete investment period, i.e. due diligence, contract, participation and sale phases. During the investment’s participation phase the non-exhaustive services provided to investors are: cost, cash flow & accounting controls, quarterly reporting, market monitoring, investor representation vs. Briese Schiffahrt, preparation of shareholder resultions (charter contracts, repairs, investments, sale), support to benefit from the German ‘tonnage tax’ in Switzerland etc..

Most of the new environmentally friendly energy production (e.g. wind power) or old infrastructure (e.g. oil rigs) that needs to be disposed is transported by sea. This is the core competence of the multipurpose & project carrier industry. With the expression “Green Shipping” the industry understands a whole slew of new technologies and initiatives to reduce the environmental impact of its activities. To name a few…

The experts of the Sustainability Lab of the Swiss Federal Institute of Technology (ETH) in Zurich have published a study which deals with different concepts and incentives on how to achieve “Net Zero” by 2050. In primarily concentrating on the Baltic Sea (Ostsee), they have been able to be much more specific than other authors in other studies.

All vessels owned by Briese Schiffahrt and its operators are adhering to the environmental standards set by IMO and other organizations. As the market leader Briese Schiffahrt also thrives innovation that can be experienced by its new “LakerMax”-series which are up to 40% more eco-efficient and therefore receive the IMO-GHG “A” Rating.

Under the catchphrase «Green New Deal” the call for public policy changes to address the negative consequences of climate change can be summed-up. Therefore, it should be noted that “Green Shipping” initiatives deal with a number of additional aspects that do not fall into the scope of «Green New Deal”. The shipping industry produces roughly 3% of all CO2 emissions, 15% of all NoX emissions and 13% of all Sulphur emissions. Since 2008 maritime CO2 emissions could be reduced by over 18 %. However, there is further potential for improvement. To name a few:

In particular ongoing discussions on the future regulatory framework of the shipping industry has severely reduced the newbuilding rate. Shipowners are reluctant to commit to large building programs, when a dramatic change of regulations could result in “stranded assets”. However, this fear may be largely unfounded as can be seen in prior environmental initiatives like to move to double-hulled tankers after the “Erica” environmental disaster. As the market leader Briese Group takes these issues seriously and has been always active at the forefront of this movement for a number of years, being the first adopter of the “Skysails” technology to reduce fuel consumption.

To further accelerate the movement Briese Schiffahrt has ordered a total of 15 vessels of its new “LakerMax” series which will enter the market in spring 2024 until early 2026.

© Briese Schiffahrt (Schweiz) AG, Zurich. All Rights Reserved.

BRIESE SCHIFFAHRT (SCHWEIZ) AG

St. Annagasse 18

CH-8001 Zürich

+41 44 503 54 40

info@briese.ch

www.briese.ch